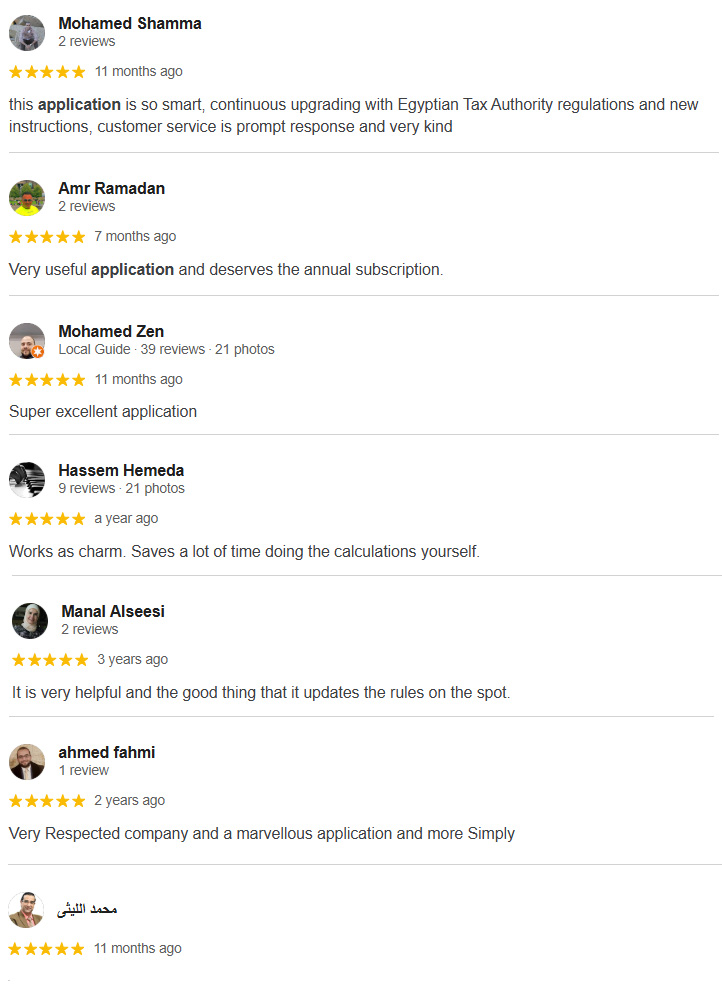

YES, You can have peace of mind that your payroll calculations are accurate, up-to-date, and

compliant with legal requirements.

PRIME

TAX EG Prime

Calculate from

Any device,

Anytime

and Anywhere.

Use this calculator to calculate salaries tax, insurance wage, social insurance, excluded allowances, and martyrs' families fund automatically based on the total salary or net salary (GROSSING UP) according to the latest legalizations in Egypt.

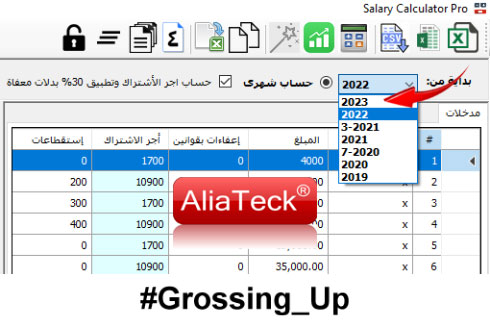

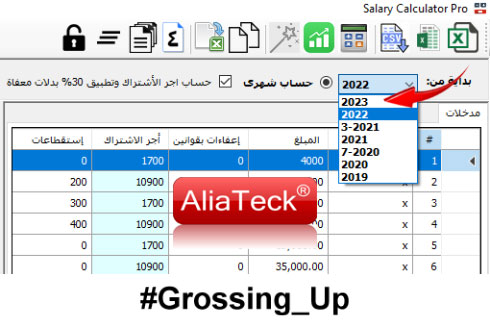

PRO

Salary Calculator PRO

Net to Gross Salary

Calculate gross salary, tax value, social insurance, and all mandatory deductions according to net salary for more than 10,000 employees in less than 1 second.

NEW

MANZOMA PLUS

Full compatibility with the Unified Basis and Standards System for calculating payroll taxes by the Egyptian Tax Authority.

Success Partners

.png)

.png)